Webinar Overview: GeoInsurance and Climate Change 2021

GEOINSURANCE & CLIMATE CHANGE

ADDRESSING TODAY FOR THE UNWRITTEN TOMORROW

KEY TAKE-AWAYS:

- The UK is not immune from climate-related risks and can expect increased heatwaves in the summer, as well as flooding from rivers, landslides in heavy rain, and increased wildfires and droughts if global trends continue without mitigation.

- A litany of change – environmentally and regulatory – will impact financial services organisations and their day-to-day practices.

- Overwhelming perhaps – but support, guidance, and solutions based on your best practice are here – an antidote in a sea of potential chaos – enabling businesses to address today for the unwritten tomorrow.

Shining Light on the Darkness of Climate Change

Michael Gaughan, Head of Strategic Growth at Gamma Location Intelligence, gallantly stepped forward to host and introduce the UK session of the GeoInsurance webinar series.

It is undeniable that the risks associated with climate change are increasing in frequency and severity.

The insurance market – and asset owners more generally – face a growing need for a much more comprehensive approach to underwriting, pricing, and investment strategies.

Clearly it is no coincidence that alongside agreements and plans coming from COP26 that Flood RE stated the need for greater focus on flood resilience, continued long term focus on flood defences and an appeal to ensure that new homes are built in the right place.

So, the insurance industry has a key role to play in managing, understanding, and analysing risk.

Put simply, money does not get invested without a view on risk which we will touch upon today.

And whilst this can feel particularly overwhelming, we hope that today we can illustrate that environmental, analytical, and regulatory pressures are not insurmountable.

Addressing today, for the unwritten tomorrow.

Adaptation & Mitigation

From an academic viewpoint – and at the cutting edge of climate change research – Dr James Fitton of MaREI and UCC took the reins to walk through the evidence of climate change and its potential impact on the UK.

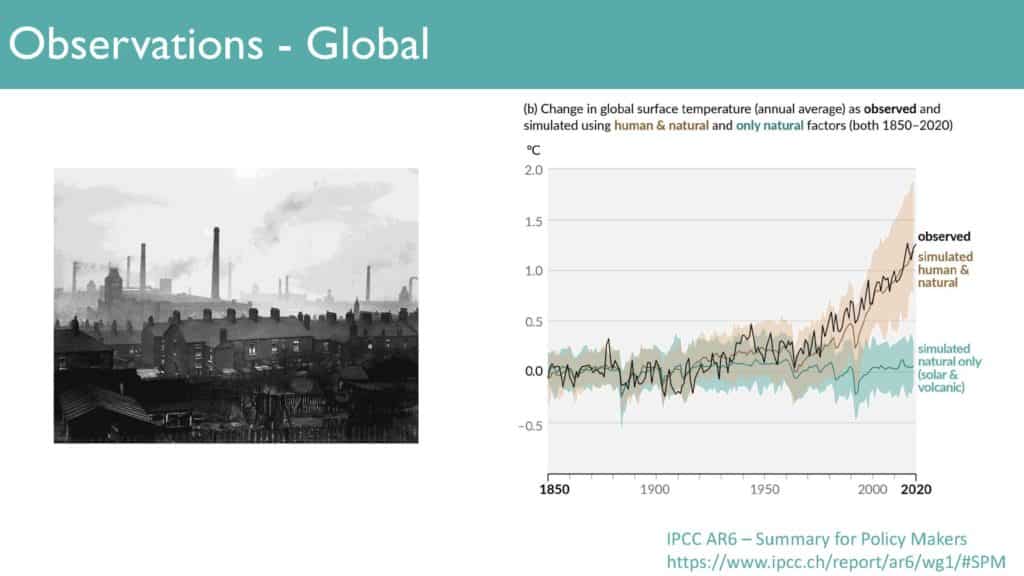

Setting the scene, Dr Fitton covered the fundamentals from where the planet was pre-industrialisation, to observed upward temperature records of the post-industrial era. The evidence is a massive up-tick (comparatively) in global temperatures and extreme weather events over the last 200 years. It is largely undenied that human influence – industrialisation, activities and the burning of fossil fuels that have been the catalysts to rising climates globally for many years.

Slide Image 1: The observed and measured view over the last 200 years – change is due to industrialisation and human activity, going beyond the impact of natural processes alone

The UK is affected in the same way as any other country with warming of almost 1-degree during the post-industrialisation period. That upward trend is predicted to continue across the UK over the coming years.

It is happening. It will come to pass.

But what does it mean for the UK…?

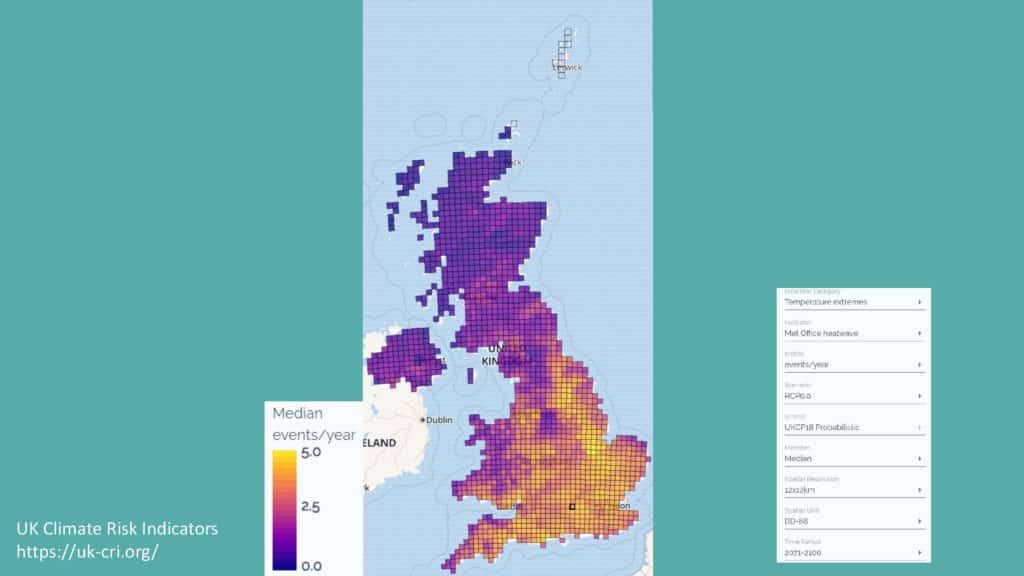

UK climate risk assessment – increase in temperature regardless of region – the UK is not immune.

Future projections show that heatwaves will be more frequent and more intense. The level of precipitation will increase. As will river flooding and flash floods. And landslides.

Slide Image 2: Risk projections (heatwaves) visualised spatially across the UK

Conversely, hydrological and ecological droughts will increase – creating the perfect conditions for wildfires and the increase in their potency and frequency.

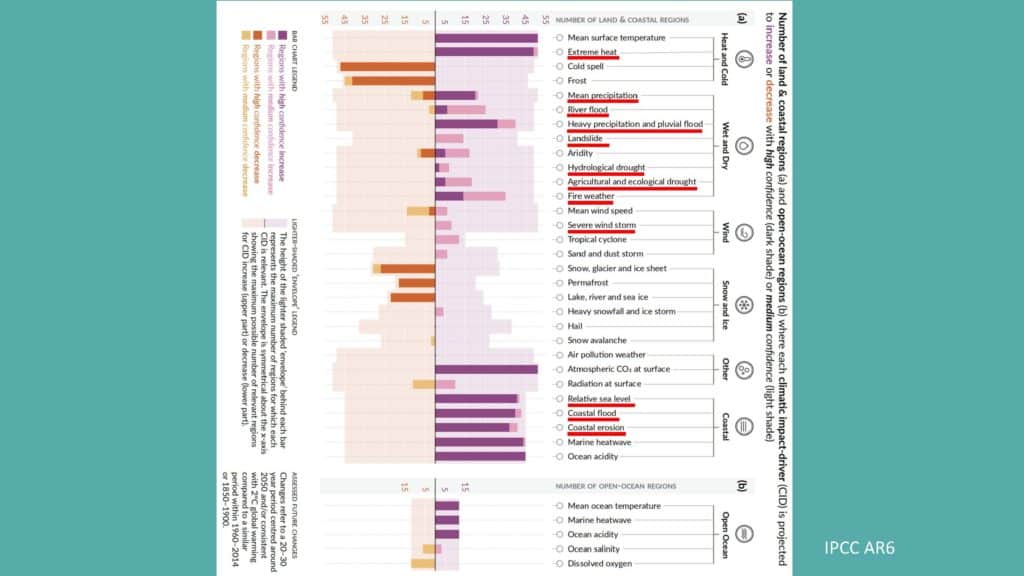

Windstorm evidence and projections aren’t as well developed. However, whilst the projection of increased frequency is less clear, there is strong evidence in the projected increase in intensity of windstorm events. Speed is the most destructive element, but the coastal nature of much of the UK also means that stronger, faster windstorms can cause catastrophic sea surge and coastal erosion damage associated with rises in sea levels.

Slide Image 3: Severe risks in context

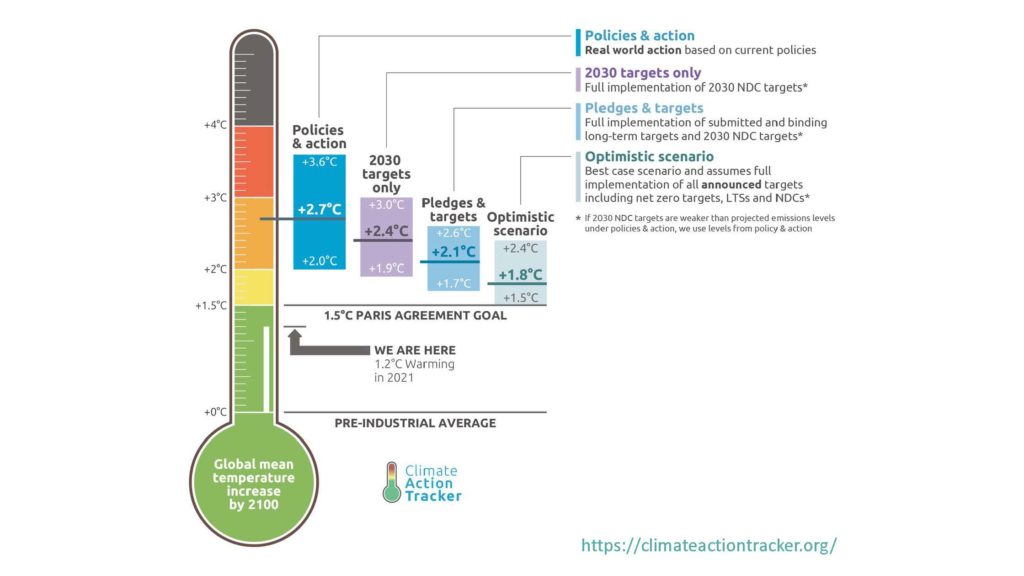

The long-term view is hard to digest, but the need to change is now.

Agreements and the implementation of proposals at COP26 is a step in the right direction, but still above the target of 1.5-degree change in global warming. So even with planned action, some of the hazards will come to pass.

Slide Image 4: Visual summary of COP progress & agreements

As such, the key takeaway is that Adaptation and Mitigation are essential:

- Adaptation to the current and future climate

- Mitigation in terms of reducing our emissions to limit future global temperature rises.

More to do, but we can all play our part.

We need to stop kicking the “climate change can” down the road and start to worry – and make contingencies – for change. Without planning and change, the potential is for economies and businesses to collapse.

It sounds doomsday like, but it’s the trendline sadly.

Helpful Steps in an Evolving Journey

So how do we mitigate and start to implement for the future…?

Richard Cantwell, principal consultant at Gamma LI, takes a look at the practicalities of the day-to-day use of climate change projections – as an aid to decision making in the UK today.

Building on the academic theory and projections, Richard took a view on the “day-to-day” impact from an individual property perspective.

Underpinning this section of the webinar – and the project examples illustrated – was one of the standout points from the IPCC report, which stated:

“What is currently a 1-in-100-year extreme sea level (ESL) height…

will be expected once or even multiple times per year in the future at many locations”.

Essentially, what was once rare will become more common place. Validating the point made by Dr Fitton in that it is the increased frequency in events that will be seen in most well researched cases of climate change impacts.

And of course, with more common (frequent) events there lies the potential for more common (frequent) damage to life, property, and the environment we associate with.

A key resource for the professional and casual observer is the Interactive Atlas for Northern Europe which highlights key projected outcomes [LINK]:

- Increase in mean and extreme heat

- Reduction in cold spells

- Mean and heavy precipitation and pluvial flood are set to increase

- Severe windstorms show a moderate confidence in potential increase

- Whilst relative sea-level, coats erosion and coastal flood show a high level of confidence in projected increases.

All these measures are important and are of collective concern. However, given limited time the primary focus was on the impact of flooding – which is also perhaps the most relatable impact of climate change for many of us.

Utilising data from the likes of OSNI, OSI, OS, Geological Survey of Ireland, British Geological Survey, Ambiental, JBA, BlueSky, Metswift, and Terrafirma in combination with Gamma LI’s own data we were walked through how data that is available today can help address decision making for tomorrow.

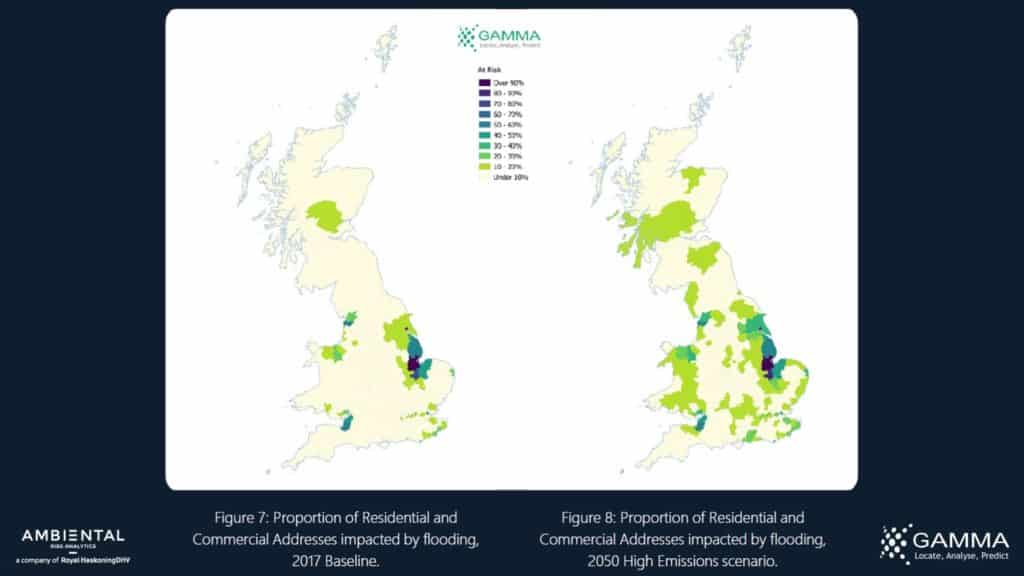

Slide Image 5: The impact of flooding based on emissions predictions into 2050

Coverage maps illustrating the widespread nature of flood events can be particularly hard hitting. A visual perspective on what the predictions might mean.

But it’s digging into the detail – by region, town, street, property – where the real impact can be seen. Additional statistics can be found in Gamma’s whitepaper.

However, it is looking at this detail and the projected change over time in terms of flood risk associated with individual properties that is a key use case for those who own, service and/or manage these assets.

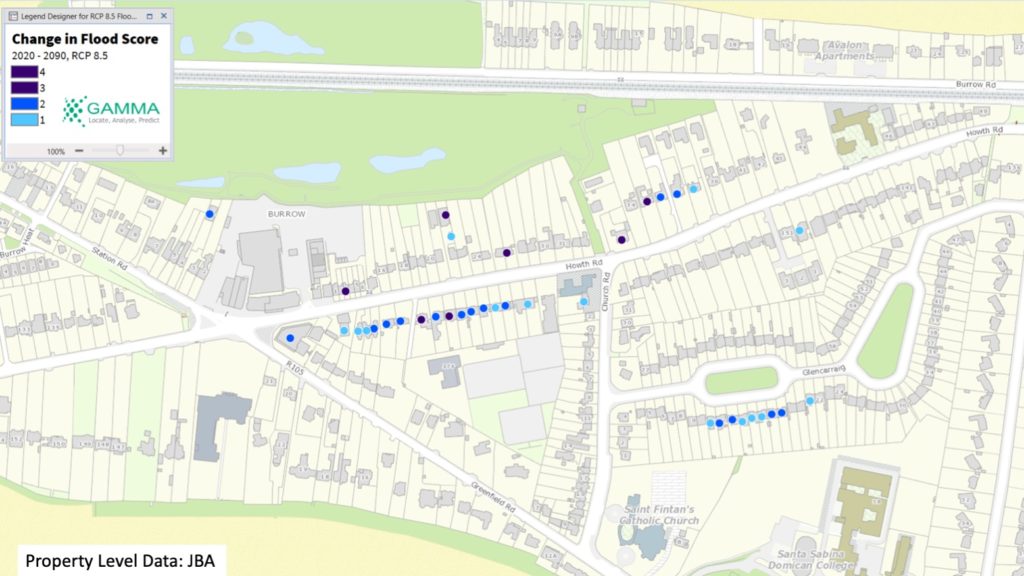

Slide Image 6: Applying broad scenario insights to individual property risk

For example, a rise in predicted events will result in a growth in the number of properties affected. In certain locations – even in towns not traditionally associated with flooding to date – we see the potential of impacted properties growing from 1-in-20 to 1-in-5 affected. That could have a colossal impact on all of those invested.

Of course, it’s not only water that can be devastating.

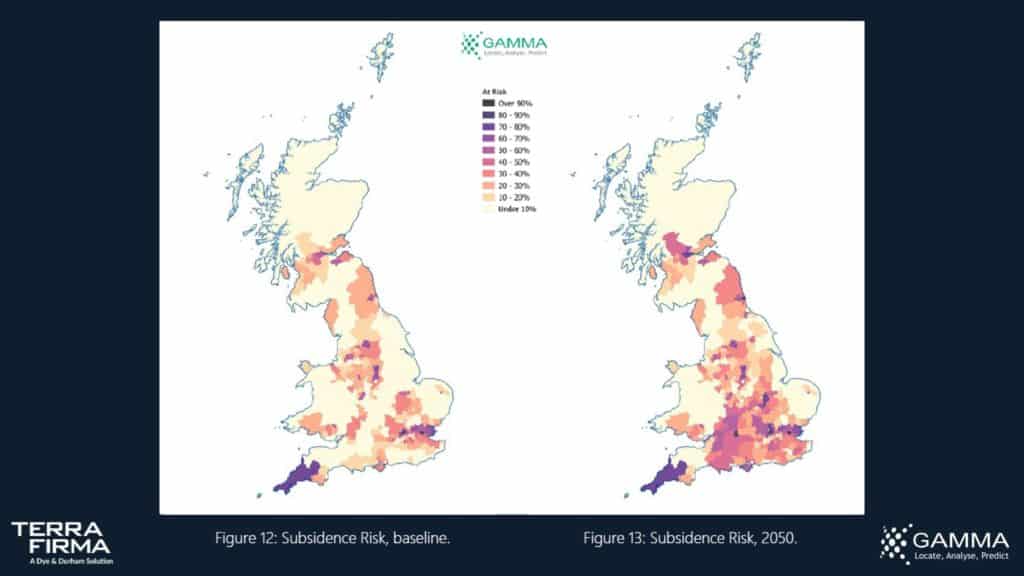

When coupled with increased temperature rises and extended periods of drought, then these are the perfect conditions for shrink-swell scenarios to prevail.

Slide Image 7: Properties at high & severe risk from tree collapse/storm damage in Perilfinder

The south-east is particularly prone – impacts are being felt here today, so the projected increase in their intensity will only make their occurrence more likely.

Yet, as with projected flooding, the widespread nature in terms of the increase in such hazards is – or should be – the major concern for asset owners.

Again, it’s the veracity of the potential increase in shrink-swell risk. Where we currently see single-digit exposure to housing stock, it’s the potential for exposure to rise significantly – in many places exponentially – in terms of the volume of properties that will be impacted by subsidence in the future.

We also looked at storms and wind speeds and the impacts that they have on buildings and the built environment based on proximity to trees and river estuaries. And soil data can provide a view on shrink-swell impacts which are a primary cause of subsidence related issues.

Collating these datasets and delivering them in a meaningful way to clients – whether via a Gamma LI solution or through APIs – to enhance asset owners understanding of potential risk and to place context within their decision-making processes.

Slide Image 8: Properties at high & severe risk from tree collapse/storm damage in Perilfinder

Plenty of models exist to aid decision-making – how insurers and financial services organisations choose to consume them depends on their appetite for risk.

It is inevitable that climate change will have an impact on properties across the UK.

The Inevitability of Compliance

Alongside the changing nature, quality and coverage of data is the irrepressible force of regulatory change and compliance.

Delivering the view of regulatory change and evolving market practices in the UK market was the knowledgeable and vastly experienced duty of Dorian Hicks, partner, and actuarial lead at Mazars in the UK.

From the outset Dorian clarifies that climate change poses different risks:

- Physical risk – factors specifically relating to weather events and longer-term shifts in the climate (climate change). We should be under no illusion that physical risks are changing.

- Transition risks – arising from the process of adjustment as we move towards a low-carbon and climate resilient future.

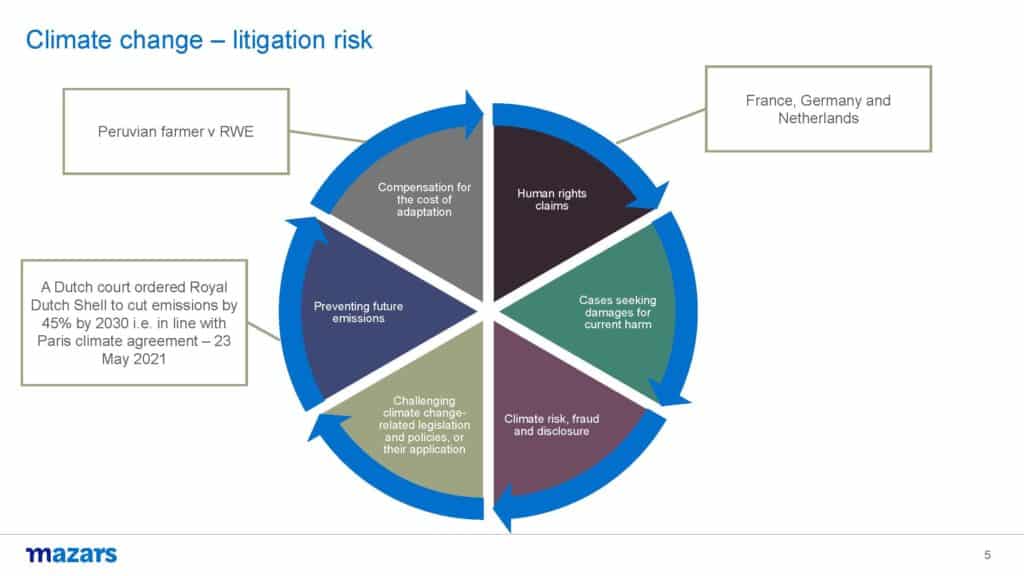

- Litigation risks – where compensation is sought for losses suffered from physical or transition risks associated with climate change.

Litigation requires specific mitigation in its own right. And this has been explicitly drawn out by the regulator.

Drawing an analogy – and lessons to reflect upon – is litigation relating to tobacco and the evolution of lawsuits against the industry. A process that may have been 50 years in the making, but with attribution science having played catch-up, has seen significant litigation take place.

Surely nobody can mistake the similarities in that with climate change.

And by way of reinforcing that point, there is growing evidence of legal precedents having taken place. Some in relation to human rights and the prevention of future emissions.

But the standout example is that relating to compensation for the cost of adaptation (due to the effects and impact of climate change) and the suit bought by a Peruvian farmer against RWE (multinational energy company), for their contribution to the greenhouse gas emissions that are causing nearby mountain glaciers to melt and thereby increasing flooding risk. The case was initially dismissed but the higher regional court then ruled then the case was well founded and could proceed to evidence gathering.

The impact of this is clear in terms of its far-reaching consequences – and whilst the potential for similar claims is perhaps currently low – it is a fact that these risks exist. And if a risk exists, it is prudent and appropriate that it should be considered, especially in terms of liability, but also into terms of assets.

Slide Image 9: Litigation risks – if a risk exists, it needs to be understood & managed

That’s the “sticker shock”, so what should happen next..?

Well, policy action is required – and whilst progress is slow the recommendation is to grasp the nettle before control is mandated.

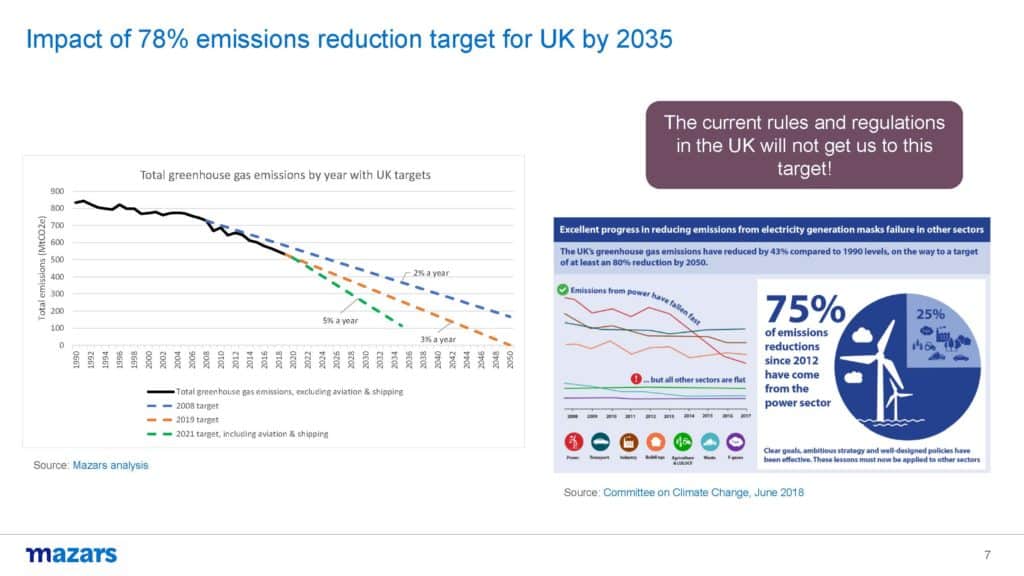

In the UK, in general terms, progress towards a low-carbon economy has been reasonably good.

However, to meet our future commitments then current rules and regulations will not get us to the target we need to achieve. In the time we intend to achieve it.

Every sector will be impacted. Reporting upon and cutting emissions will be mandated.

Slide Image 10: UK emissions targets

In terms of the regulators the focus is on insurance resilience to climate change. And there are 3 key pillars to the approach:

- Stress and scenario testing – ensuring the financial system is resilient to climate-related financial risk

- Supporting an orderly economy-wide transition to net-zero emissions – policies need to be in place inside the next 12 months for the largest companies. All companies will ultimately follow.

- Promoting adoption of effective TCFD-aligned climate disclosure – adequately disclose risks to the business and other aspects.

Scenario testing is hugely beneficial – a key component of which is data. As we’ve seen during the session, useable, appropriate data that reflects the potential impact of certain scenarios exists – the skill is in harnessing, reporting, and managing that data to deliver what is required.

And whilst the predominance of annual policies does insulate insurers to a degree – the ability to make informed decisions based on new and updated information will be critical. Or more critical than it may be perceived today.

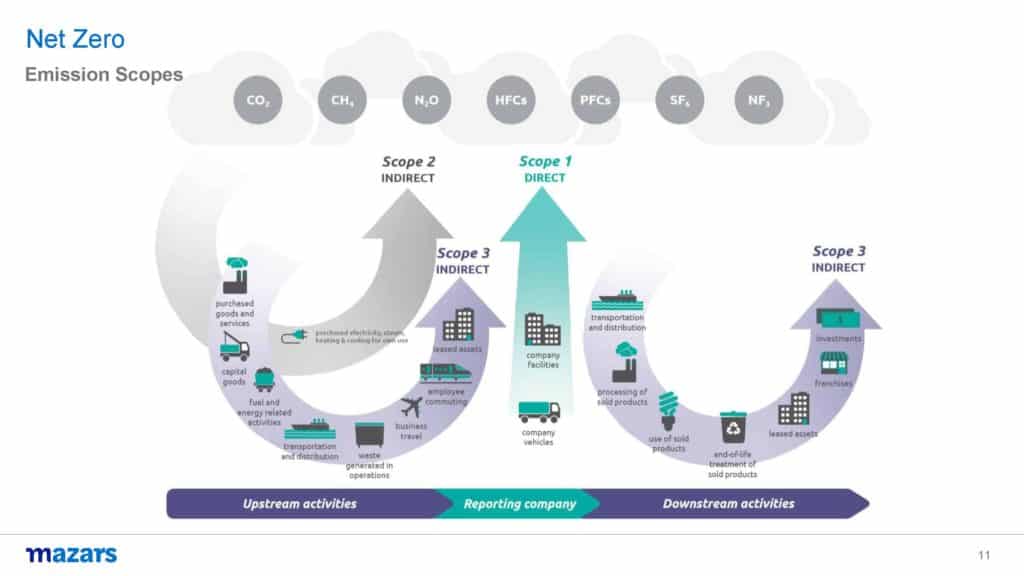

Similarly, the concept of Net-Zero is relatively well understood and easy to report upon and mitigate for – certainly in terms of Scope 1 (direct emissions) and Scope 2 (indirect emissions associated with electricity and heating/cooling requirements), although Scope 3 (indirect emissions associated with everything else) – most of which is difficult to measure – and so companies have tended to focus on business travel and employee commuting as key elements to report on as they are relatively easier to measure.

Slide Image 11: Achieving Net-Zero reporting by scope – it’s a journey, not necessarily a destination

Brands like Aviva and Microsoft are vanguards in the reporting of their Net-Zero targets. Aspirational perhaps, but imitation of their approaches is advisable.

Finally, the future of governance.

Slide Image 12: The future of governance

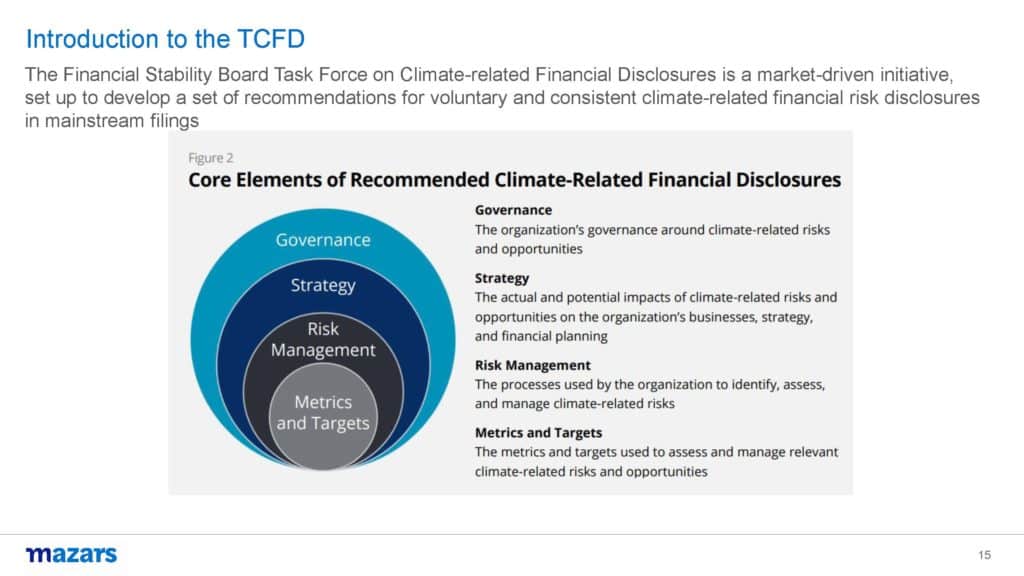

TCFD is a market-driven initiative set up to develop a set of recommendations for voluntary and consistent climate-related risk disclosure. The focus for these disclosures is the alignment with mainstream filings and will be in place by 2025 – although for many are targeting the end of 2023.

In summary, the embracing of regulatory change is very much about business taking responsibility – regardless of enforcement, companies should be considering their impact and the risk they are exposed to and/or are creating.

The need to do so is now.

And as overwhelming as this all seems support, experience, and viable solutions – that will evolve as business and requirements change – are available today.

Helping organisations like yours embrace the change we see today, in order for you to address the unwritten tomorrow.

Trusted Solutions for Now & Tomorrow

So, by way of wrapping up the session with how Gamma LI may help resolve some of this challenge is Richard Garry, Chief Commercial Officer at Gamma LI.

Richards’ focus was on how Gamma LI can help insurers and asset owners take climate-related data, fuse it with regulatory compliance requirements and reporting, and then take action to deliver results that the business needs.

Although first off – in case anyone is uncertain – who is Gamma Location Intelligence…?

Slide Image 13: Gamma Location Intelligence

In essence – and in a desire to keep it brief – Gamma LI enables clients to quantify risk impacts on their business.

We take the science and data that is available today – in order to make action possible to mitigate for the unwritten tomorrow. Linking data to building footprints (individual property) and aggregated for analysis/reporting purposes.

Drawing on Gamma LI’s multi-sector experience, Richard touched on the outcomes of various projects that look to appraise the impact of climate change on organisations that insure and/or manage physical assets – from exposure related to banks mortgage books through property backed loan portfolios, as well appraisal of projected impacts on businesses across Local Authorities, Utilities, Telecoms, Property agencies and Retail.

Slide Image 14: The challenges that Insurers (as well as Investors, Lenders and Asset owners) need to appraise.

Essentially, better enabling any organisation that owns or manages property – and is keen to understand the environmental risks that will impact those properties.

Easily said – but perhaps more challenging – and often overwhelming – for businesses of all shapes and sizes to implement.

Whilst we know that climate change is happening – with extreme weather events happening on a more regular basis – much of the forecasting is future looking – often many, many years ahead – and perhaps feels less immediate, especially if you are writing business today.

How does the catastrophe predicted in 2050, really impact me today and my prospective customer for the next 1, 3, 5, or 10 years…?

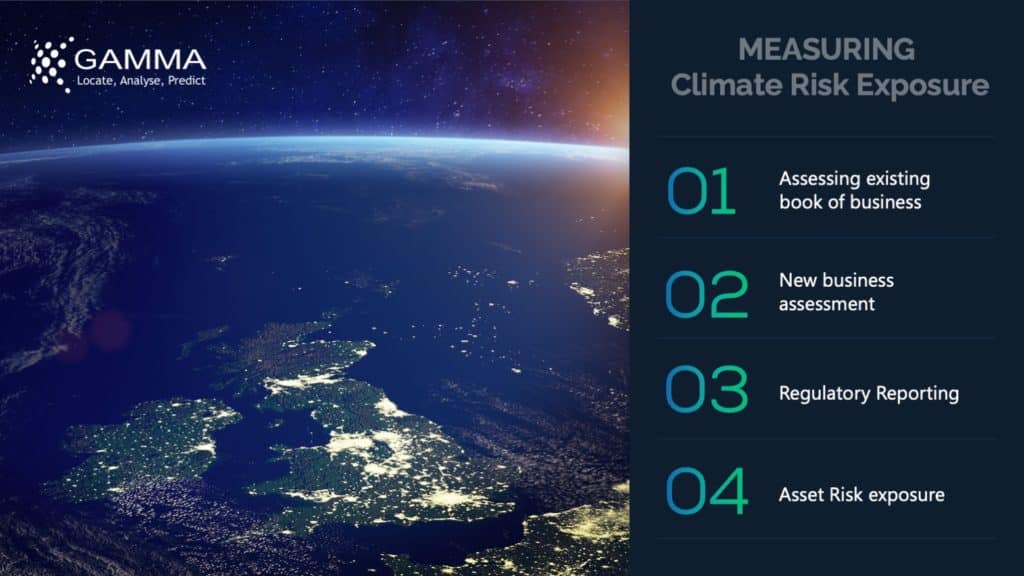

But as time continues to move forward there are considerations that we should be making today to limit the risk exposure of climate change, such as:

- Assessing the impact on your existing book of business

- Integrating the impacts into your “business as usual” process to understand (near future) risk at the point of policy inception – streamlining and managing the data in line with your process

- Changes in and drive towards more regulatory reporting with regards to risks impacted by climate change, and

- Impact of climate change on investments (asset risk exposure)– long term investments and the future potential impact prior to investing large amounts of capital into a project or development that may have the potential to be severely impacted by climate change.

Each of these Gamma enables clients to consume during their usual trading processes and procedures – empowering clients to better mitigate risk and make well informed decisions.

As overwhelming as this all seems support, experience, and viable solutions – that will evolve as business and requirements change – are available today.

Helping organisations like yours embrace the change we see today, in order for you to address the unwritten tomorrow.

@ 2021 Gammali.co.uk by Jason Day

About Gamma Location Intelligence

Gamma Location Intelligence (Gamma LI) is a cloud hosted solutions provider that integrates software, data and services to help our clients reduce risk through location intelligence. Established in Dublin, Ireland in 1993, and with offices in Manchester, UK and Bilbao Spain, the company has expanded to become a global provider of cloud-native location intelligent systems and services. Gamma LI’s Perilfinder™ risk mapping platform provides property underwriters with access to trusted property-level risk data easily, quickly and accurately.