Gamma Location Intelligence harnesses AI, data science and spatial analytics to produce solutions to geographical questions. Chief Commercial Officer Richard Garry talks to Simon Fyles about location intelligence innovation and how Gamma is helping insurers to reduce risk.

Simon: Can you start with some background on Gamma?

Richard: Gamma Location Intelligence is a global provider of cloud-hosted, spatial and geographical intelligence solutions (GIS). We integrate software, data and services to help clients, including insurance companies, reduce risk through Location Intelligence (LI). The company’s headquarters are in Dublin, but we have offices in Manchester in the UK and Bilbao in Spain.

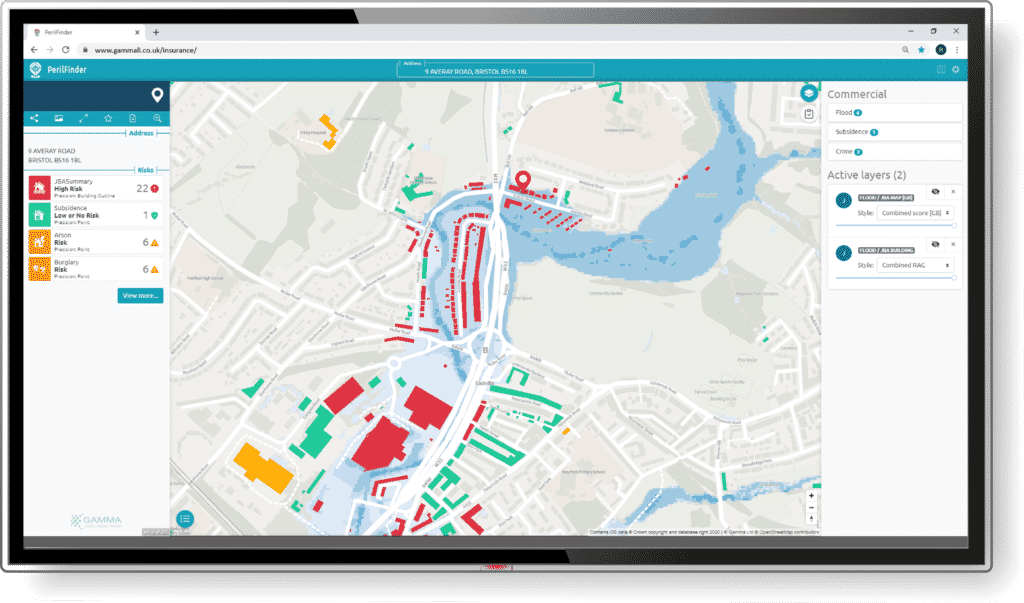

One of our core software platforms is Perilfinder, which is an underwriter’s risk assessment and reporting solution which provides information based on UK and international addresses. The platform incorporates rooftop level geocoding, map visualisations, risk and accumulation scoring and spatial peril models including flood, subsidence, fire and crime.

Simon: What’s your role and what does it involve?

Richard: I manage our relationships with clients and partners, coordinating everything from the initial engagement and organising contracts to overseeing project completion and ongoing account management.

As a lot of Gamma’s solutions are new to the market, we work closely with prospective and existing clients to understand their location intelligence needs. We can develop tailored solutions to meet specific objectives, enable better decision-making and lower a client’s investment risk.

Simon: How are your clients using Perilfinder? Can you give us an example of the data at work?

Richard: The technology can be integrated into a customer’s systems or provided as a web service. It allows insurance companies to make informed decisions around location risk and lowering operational costs, with integrated environmental risk models including flood, subsidence, crime and fire.

To give you an example, an analysis we conducted using Perilfinder at the end of last year showed that climate change will see more than 1.2 million properties in Great Britain newly at risk of flooding by 2050.

Based on the worst-case scenario in this analysis and using Association of British Insurers figures on average pay-outs of flood claims in February 2020 following storms Ciara and Dennis, this poses a potential insurance liability of £122 billion.

Buildings highlighted with JBA flood risk on the Perilfinder platform

Simon: In terms of innovation, what are you focusing on right now?

Richard: We’ve just rebuilt Perilfinder using serverless AWS infrastructure and the latest vector mapping technology. We’ve utilised new datasets from the Ordnance Survey and other sources to provide building-level attributes, incorporated the latest risk data from JBA Risk Management, Ambiental Risk Analytics and the British Geological Survey, as well as new datasets from Terrafirma and Metswift. We added in burglary and arson data to provide a one-stop-shop for insurance companies in terms of risk data.

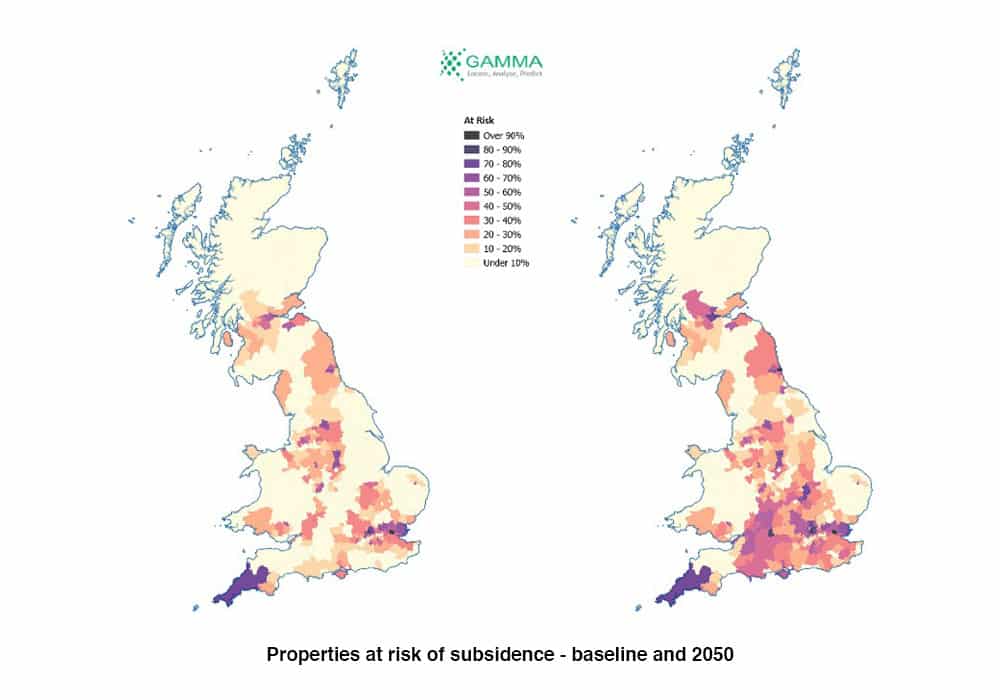

Climate change is a big area for us. We’re working with JBA and Ambiental as they develop their climate change models to factor in scenarios required by regulators. We have also brought Terrafirma’s National Ground Risk Model (NGRM) climate data into Perilfinder.

The NGRM is a significant innovation from Terrafirma and uses the latest UK Climate Projections (UKCP18) to identify properties which will be impacted by climate change in the future.

Our partners view us as a provider ready to offer this climate change assessment to customers. From the moment they started developing it, we started putting it into our platform and developing the missing variables, including data for the Republic of Ireland.

Simon: Do you feel insurers are changing their views on climate change?

Richard: Climate change has been talked about for years, but 2020 was the year we saw the talk translated into action. There is significant financial risk associated with climate change and location intelligence can help quantify, inform and reduce that risk – for internal decision-makers, investors or regulators.

While flood risk is widely discussed, another area that has not been explored is the potential impact of climate change on ground movement and the impact this can have years from now. We’re going to see a lot more interest in this area going forward.

Simon: What does your data show about the risk from ground movement? Can you quantify it?

Richard: Analysis we carried out at the end of last year showed that a further 1.9m addresses in Great Britain will be at risk of subsidence by 2050 as a result of climate change.

That will have a major impact on insurance companies. The Association of British Insurers found that average subsidence-related claims range between £6,000 and £12,000. The current subsidence-related annual average loss to insurance companies is £60m. By 2050, that is expected to increase to over £150m per annum.

Simon: Gamma has made a big investment in partnerships and data sources. How do you analyse that data and what are some of the client benefits?

Richard: We pride ourselves on delivering the highest quality data to our customers and we need the right partners to do that. By understanding the differences and benefits of each data set, we can provide independent support to clients to help their decision making.

Our aim is to establish Perilfinder as the platform that delivers all the peril data that is relevant to the insurance sector, and our partnerships are starting to make that a reality. The data we provide can lower risk, enhance product delivery, and save valuable time insurance firms spend on risk assessment at the point of sale and in terms of the back office.

Simon: Which insurance companies are you working with?

Richard: We work with some of the largest insurance companies in Ireland and the UK, including three of Europe’s top five insurance companies.

Our position in the UK market is growing, having recently signed a contract with MGA Mutual. We help the company to better understand location-based risks for the SME sector by visualising the risks through a single platform and providing peril-related APIs that integrate with MGA Mutual’s underwriting platform.

We pride ourselves on our outstanding customer service and going above and beyond a standard service level agreement with our clients. Many of the organisations we work with have been with us for years, and it’s a testament to our commitment to providing bespoke, tailored solutions that we have never lost an insurance client.

Simon: What will be the focus of your activities over the next year?

Richard: 2021 will be a big year for Gamma. We are investing in our technology and partnerships, with a view to being able to offer Perilfinder to insurance companies across Europe, the Middle East and Africa.

We’re also focused on developing AddressLink, our property-level data repository, to add more data providers onto our platform.

Simon: How does AddressLink help your clients?

Richard: Clients want to know more about buildings. They have told us that they can’t make decisions based on the current data available in the market. There is also an issue with relying on customers to know and input the data about their building, which is prone to both errors and potential fraud.

Our clients need to be able to access and rely on a data source that’s been validated by a third party, which is what we’re building out with AddressLink. We’re including information on things like building height, the age of buildings, the number of floors, which is pre-filled to save the clients and their customers time during onboarding.

We believe that AddressLink is the first data source of its kind covering the whole of Ireland, Scotland, Wales and England. In some cases we can fill data gaps by modelling data from one area to another. If there is data available for England and Wales but not Scotland, we can use what’s available and model it for Scotland.

Simon: Why did Gamma decide to join InsTech London?

Richard: We attended many of InsTech London’s presentations throughout 2020, so it was easy to make the decision to join. We felt that the webinars and content were a natural fit for an organisation like ours, which prides itself on delivering real value for clients.

Simon: What kind of companies or propositions would you like to connect with?

Richard: Our aim in 2021 and 2022 is to grow our brand awareness and connect with as many P&C insurance companies and MGA’s as possible. We can provide a solution for any organisation that needs to understand the risks associated with a property – whether that is flood, subsidence, crime or fire risk. Through Perilfinder, Gamma can help insurance companies reduce costs and risk using key information provided via user-friendly dashboards.

We are also keen to provide more valuable data to clients by expanding our data partnership base, so we would welcome any interested parties in this space.

Another potential growth area for flood and climate change data is the lending sector, so we are also looking to connect with organisations providing long-term property loans or mortgages as they could be impacted by climate change during the lifetime of the mortgage.

Simon: What can you bring to the community?

Richard: At Gamma, we adopt a customer-centric partnership approach focused on high-quality service and reliability. Our investment in research and development, use of emerging technologies, and passion for location intelligence can provide a fresh perspective for organisations interested in reducing risk through data.

Whether a company needs new software, a specific dataset, or wants to understand how location intelligence can support their business – talk to us and see how we can help.

Simon: What’s the best way to learn more or get in touch?

Richard: You can find out more about Gamma Location Intelligence on our website, or contact me via email at richard.garry@gammali.co.uk.

@ 2021 Gammali.co.uk

This article first appeared on February 22nd on InsTech London website.