Estimating the Potential Impact of Climate Change–driven weather-events on GB Property

The effects of climate change on property and its potential impact on the insurance sector is a topic that concerns us all. On 12 November Richard Garry, Chief Commercial Officer at Gamma & Matthew Grant, Partner at InsTech London, hosted Gamma’s GeoInsurance and Climate Change webinar as part of the GeoInsurance Webinar Series 2020.

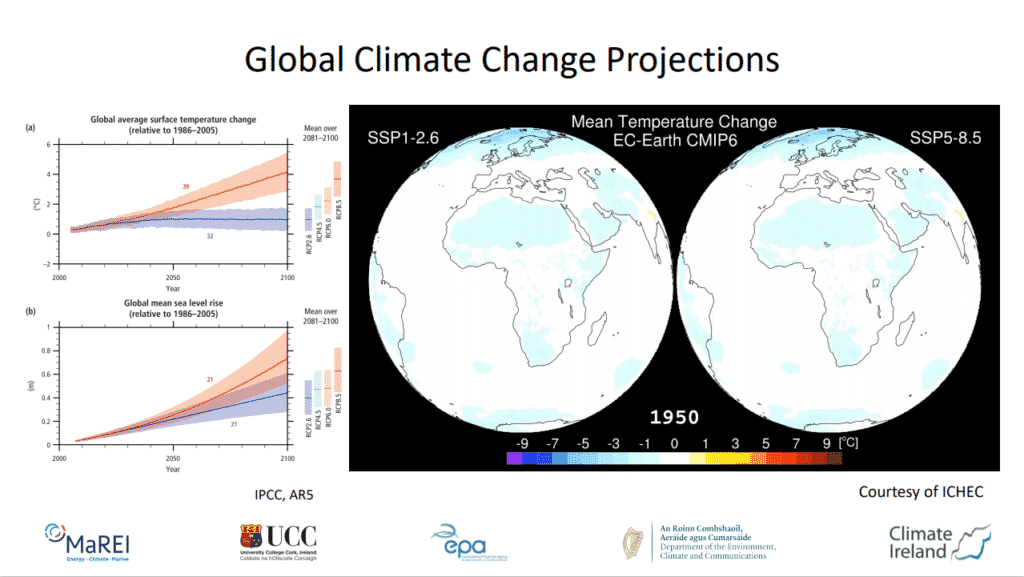

Our climate is changing. Warmer oceans are leading to increased rainfall, storms are becoming stronger and more frequent, heatwaves in summer months hotter and more prevalent, and winter months becoming significantly wetter. As a result of global climate change, it is predicted that flooding will become more severe across Europe, with Britain and Ireland particularly affected. Drier and hotter summers are already having a major impact on soil moisture levels, leading to shrinkage and subsidence.

But how can we start to quantify the potential cost of future property damage that these changes may bring, based on current data?

Measuring the impact of climate change

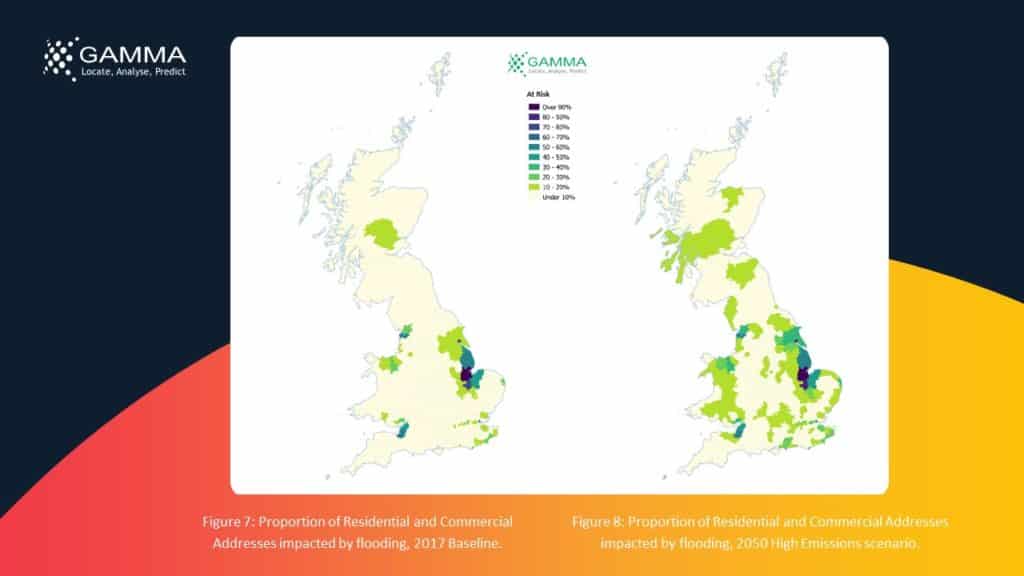

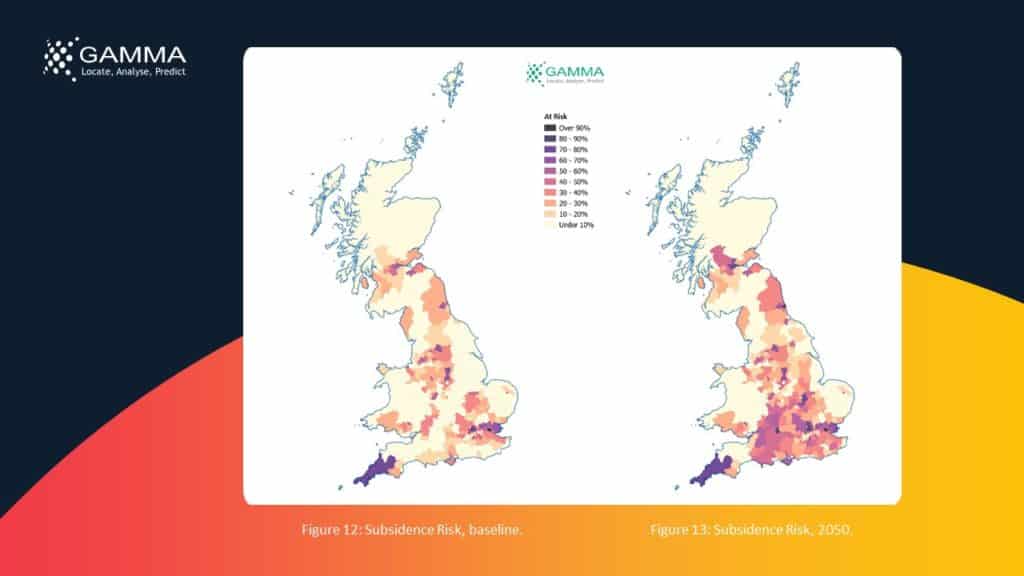

In his recent white paper, Richard Cantwell, Senior GIS Consultant with Gamma, estimated that the impact of climate change will see more than 1.2 million properties in Great Britain newly at risk of flooding, and 1.9 million addresses newly at risk of subsidence, by 2050. The UK white paper combined the latest ground movement models from Terrafirma and Ambiental Risk’s FloodFutures® climate change models to identify which parts of the UK are likely to be impacted by climate change, and to quantify the potential additional financial liability.

In this webinar, Richard provided an overview of Gamma’s recent research on climate change and property data across Ireland and the UK. In this presentation, Richard looked at how climate change will impact properties across Britain and Ireland. Increases in flooding, subsidence and extreme events are expected, but where will the effects be felt most severely? What do insurers and those working in the property sector need to know?Richard was joined by Tim Farewell from Terrafirma and David Martin of Ambiental Risk Analytics, who provided insights into how their models work.

Soil and climate change model

Dr Tim Farewell, Science and Communications Director, Terrafirma, who is an environmental data scientist with a track record of building award-winning natural hazard models for the UK, discussed ground movement and climate change modelling, and what’s important to understand about subsidence, both now and in the coming years.

FloodFutures® model

David Martin, Chief Technical Officer at Ambiental, who has extensive experience in the areas of flood risk modelling, GIS, spatial analysis, 2-D modelling and geospatial systems, spoke about FloodFutures®, a predictive flood model that considers nine possible climate change scenarios between 2020 and 2080. Ambiental developed the product to help (re)insurers, utility companies, local authorities, infrastructure managers and commercial developers understand and plan for long-term flood risk.

Climate change update and figures

We were also delighted to be joined by Dr Barry O’Dwyer from University College Cork, one of Europe’s leading experts on climate change. Dr O’Dwyer provided an update on recent developments in climate change and their likely impacts on all of us.

You can download our white papers or view our webinar using the links below.

Recent press coverage

Insurance Business – Massive prediction on insurance liability from climate change.

Continuity Insurance – Flood model suggests 1.2m buildings at risk by 2050

Energy Live News – Climate change could see 1.2m properties across Great Britain flooded by 2050

@ 2020 Gammali.co.uk by Monika Ghita

About Gamma

Gamma is a Location Intelligence (LI) solutions provider; we integrate software, data and services to help our clients reduce risk through better decision-making. Established in Dublin, Ireland in 1993, and with offices in Manchester, UK and Bilbao Spain, the company has expanded to become a global provider of information systems, micro-marketing solutions and geographical analysis services. Gamma’s Perilfinder™ risk mapping platform is a leading-edge property level underwriting solution used by P&C insurers to assess environmental risk.