How Convenient is your Brand?

As consumers, we all want convenience; it makes our lives easier. Our pursuit of hassle-free shopping has led to the rise of online and click-and-collect channels, leaving bricks and mortar stores exposed. While they may offer the same products at a similar price, many of them are losing battle ground on the convenience front.

The extent to which convenience matters depends largely on the product type. Quality and value will often outweigh convenience when it comes to expensive or long-lasting goods – you’re not going to automatically choose your nearest supplier or provider. But for fast-moving consumer goods (FMCG) and lower priced items, convenience is the most important factor in choosing which store or online site to visit.[1]

What is Convenience?

In essence, convenience is the degree of effort, or lack thereof, which a consumer has to go to in order to purchase a product from a retailer. For physical stores, that can mean the time it takes for a customer to travel to the store, park and enter the store, find the desired product and complete the purchase at the check-out. Then there are factors such as the layout of the store and availability of products. Each of these elements impact the amount of effort the customer has to put in.

The online shopping process is similar: how simple and quick is it to make a purchase in a particular online store? This includes the checkout process and payment options, efficiency of ordering and returning goods, delivery options and timeframes, the availability of click-and-collect and factors relating to collections (such as parking proximity).

Scoring and valuing all of these criteria for a target neighbourhood will determine how convenient a retail brand is in a given area. For example, Neighbourhood A could be a 12-minute drive from the nearest Brand B store. Let’s say parking takes an additional five minutes and the checkout process is usually slow, so that’s another 10 minutes. That’s 39 minutes on top of the actual shopping experience itself.

The Omni-Channel Challenge

For most retailers, convenience is an intangible and wholly immeasurable thing. How do you measure something that varies across every store and every consumer’s personal circumstances and location? Add in factors such as travel and checkout times and for many retailers, the complexity is too much. Then throw in omni-channel shopping – to include in-store, online and click and collect shopping – and we have a multi-dimensional headache to solve. Gartner’s even given it a name, calling it “multichannel location analysis” [Hype Cycle for Emerging Technologies, Gartner 2016].

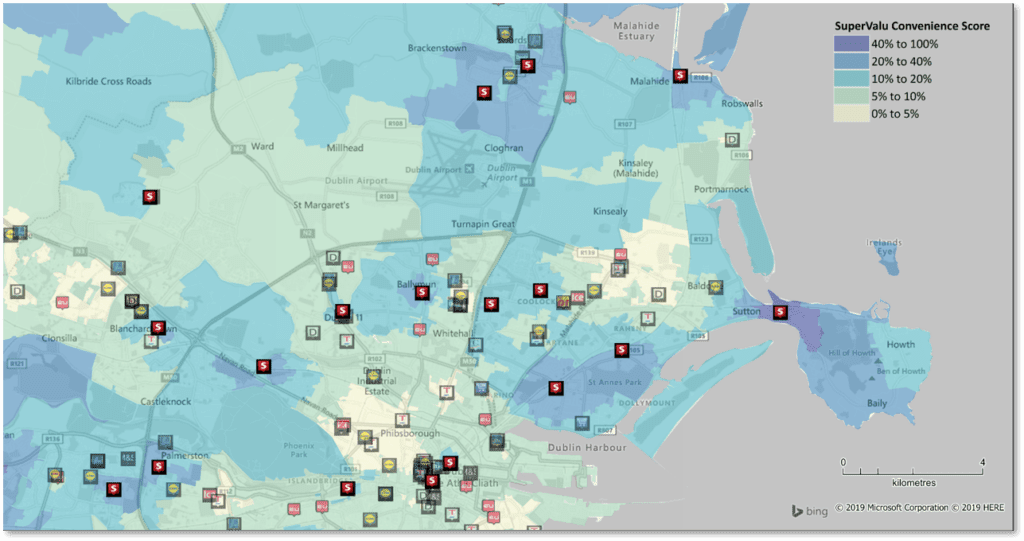

A recent study carried out by Gamma as part of our ‘Location Insights Series’ examined convenience for supermarket grocery brands. By calculating travel time from every neighbourhood to every supermarket, we were able to identify the brand closest to the most people in Ireland.[2] SuperValu scored highest, even though it doesn’t have the largest quantity of stores across the country. The key was that the brand chooses clever, convenient locations that allow it to be closer to more people than its competitors.

While this study focused on a singular facet, we have the ability to score every neighbourhood in terms of its omni-channel convenience to a specific store, brand or retail chain. It requires specialist analysis and is very data-reliant. But even brands with limited data can adopt a consistent approach that will help them measure convenience geographically.

Making an Impact

The reward for the retailer is tremendous insights into how it scores in the most important criteria affecting sales, as well as analysis on how it compares to its competitors in every town in the country – all of which are broken down according to geography. With such knowledge and an understanding of how improvements to convenience can affect market share at a micro-level, the retailer can take control of critical criteria relating to consumer choice. For instance: if I improve check-out in this store, these neighbourhoods will really benefit and my brand will become more convenient to them than my closest competitor. Or, if I close Store A, I will impact the convenience of far fewer of my customers than if I close Store B.

To adjust to the modern retail landscape, retailers must reassess their store estate and design a futureproof network that combines all channels with the customer at the centre. Store location planning now involves designing store networks that better reflect the changing nature of the retail world, with ever-evolving e-commerce models offering a multitude of customer interaction points. This makes the process considerably more complicated and now requires a broader and more flexible view on the meaning of retail presence.

Convenience should be considered, measured and analysed alongside price, service and conversion rates. Those who are evolving and adopting such an approach will be best placed to engage with a generation for whom convenience, flexibility and service are paramount. Improvements and adjustments in your brand convenience may be a slow process, held up by inflexible leases and operational difficulties, but by monitoring KPIs and making continuous small steps towards a convenience objective, you may just find the right path to your consumers.

By really knowing how your brand convenience impacts on their experience, you can make the changes to your network and distribution operations that affect those locations most in need. In the long run, this will optimise your estate investments, improve market share and make your customers happier.

@ 2019 GammaLI.co.uk by Feargal O’Neill

This article first appeared in the Retail News’ Retail News Directory 2019.

About the Author

Feargal O’Neill, chief executive officer, Gamma, has over 20 years’ experience in formulating and applying location intelligence strategies in the retail sector. As a location analytics and spatial modelling expert, Feargal helps retailers realise greater benefits from location-based information. Gamma’s Storecast™ platform assists retailers in optimising their store networks for the future.